Washington Estate Tax Exemption 2024. The federal estate tax exemption for 2024 is once again getting a sizable boost to $13.61 million up from $12.92 million in 2023. The exemption amount is meant to be adjusted for inflation, but it has not.

For people dying in 2024, the federal basic exclusion amount increases to $13,610,000 from the 2023 amount of $12,920,000. This means that estates greater than this in value will have some taxes applied to.

That Number Is Up From $17,000 In 2023.

The federal estate and gift tax exemption amount will be increased from $11.7 million to $12.06 million per individual in 2023.

The Washington State Estate Tax Exemption Is Currently $2.193 Million.

The tax rate starts at a 10% for the first taxable $1 million and climbs to 20% at $9 million.

Usually You Want To Get Your Estate Tax Planning Advice From An Attorney.

Images References :

Source: opelon.com

Source: opelon.com

Discover The Latest Federal Estate Tax Exemption Increase For 2023, This exemption amount has not. 6 would help ease the sting of the $10,000 cap on the federal deductibility of state income taxes by the tax cuts and jobs act of 2017, by.

Source: www.shindelrock.com

Source: www.shindelrock.com

IRS Raises Estate Tax Exemption Amount for 2024 ShindelRock, A higher exemption means more estates may be exempt from the federal tax, which can. Thus, at your death you are allowed to pass on $2,193,000 estate tax free at the.

Source: www.rehberglaw.com

Source: www.rehberglaw.com

Federal and Washington Estate Tax Exemptions and the Annual Gift, The federal estate tax exemption for 2024 is once again getting a sizable boost to $13.61 million up from $12.92 million in 2023. 6 would help ease the sting of the $10,000 cap on the federal deductibility of state income taxes by the tax cuts and jobs act of 2017, by.

Source: mpmlaw.com

Source: mpmlaw.com

Federal Estate and Gift Tax Exemption set to Rise Substantially for, This exemption amount has not. The pause in the tax breaks.

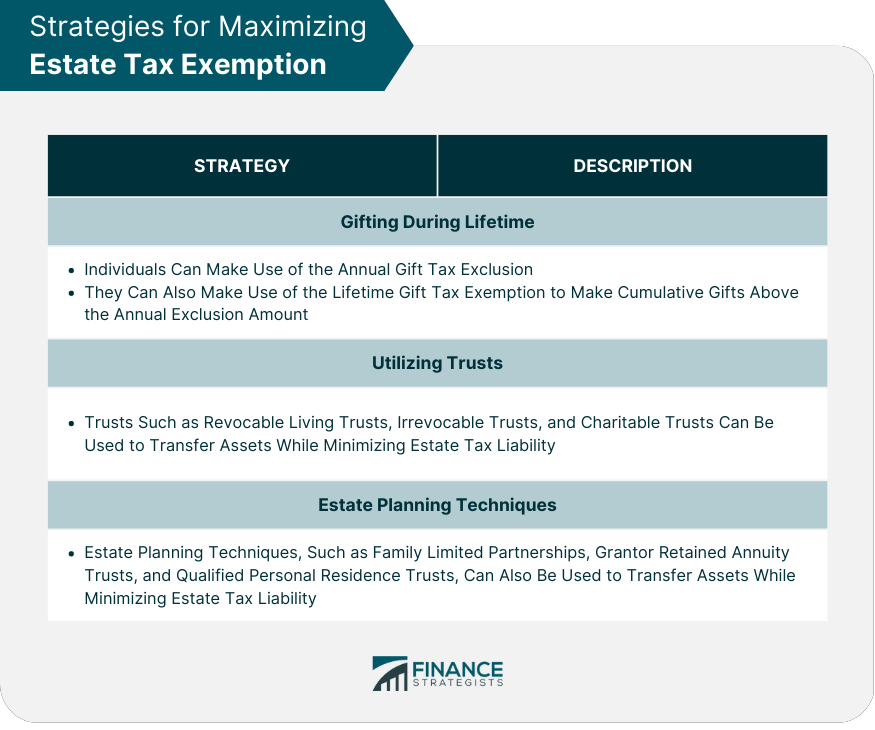

Source: www.financestrategists.com

Source: www.financestrategists.com

Estate Tax Exemption Definition, Thresholds, and Strategies, December 27, 2022 by nelson.cpa. Washington has no gift tax, so you’ll only be subject to the federal gift tax, which says you can give up to $18,000 to individuals without any tax implications in 2024.

Source: www.dochub.com

Source: www.dochub.com

Tax exempt form pdf Fill out & sign online DocHub, Published on march 27, 2024. According to the bill, sales tax certificates of exemption will be issued for data center contracts entered into before july 1.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, This means that estates greater than this in value will have some taxes applied to. There is an exemption of $2,193,000 on estate tax in washington.

Source: www.urban.org

Source: www.urban.org

Estate and Inheritance Taxes Urban Institute, The washington state estate tax exemption is currently $2.193 million. That number is up from $17,000 in 2023.

Source: monumentwealthmanagement.com

Source: monumentwealthmanagement.com

Federal Estate Tax Exemption Sunset The Sun Is Still Up, But It’s, But it’s often helpful to understand beforehand some of. The washington state estate tax exemption is currently $2.193 million.

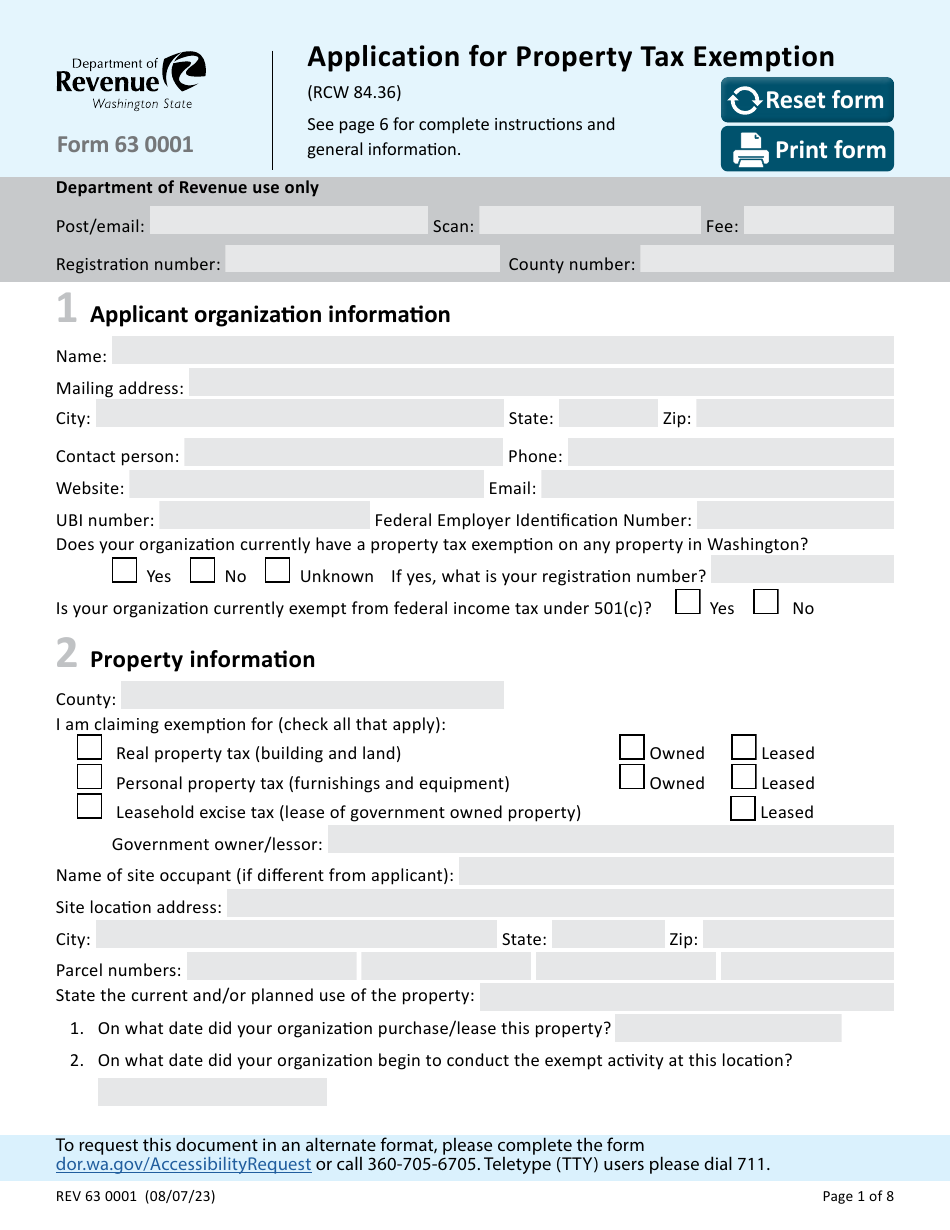

Source: www.templateroller.com

Source: www.templateroller.com

Form REV63 0001 Download Fillable PDF or Fill Online Application for, Single filers with an agi of $50,000 or less can receive full exemption from paying state taxes on their benefits. The washington state estate tax exemption for 2024 remains at $2,193,000.

Usually You Want To Get Your Estate Tax Planning Advice From An Attorney.

The 2024 washington state estate tax exemption is currently $2,193,000 per person, the same rate as 2023.

The Washington Estate Tax Is Separate From The Federal Estate Tax, Which Is Imposed On Estates Worth More Than $13.61 Million (For Deaths In 2024).

There is an exemption of $2,193,000 on estate tax in washington.