Esg Funds Performance 2024. Stock etf (esgv) due to a combination of low fees and high diversification. In the first half of 2023, sustainable funds saw a median return of 6.9%, beating traditional funds’ 3.8% and reversing their underperformance in 2022, according to a new.

Stock etf (esgv) due to a combination of low fees and high diversification. So, what can we expect in 2024?

We Expect More Of These Funds To Go To Market In 2024, As Well As An Increase In Climate Credit Funds To Fill The Demand For Capital To Fund Large Scale Projects.

From the greater focus on the impact and execution of sustainability targets, to new geopolitical and regulatory priorities, flow.

In The First Half Of 2023, Sustainable Funds Saw A Median Return Of 6.9%, Beating Traditional Funds’ 3.8% And Reversing Their Underperformance In 2022, According To A New.

(1) a substantial 83% of consumers believe companies should actively shape esg best.

What Is Next For Esg In 2024?

Images References :

Source: www.morningstar.com

Source: www.morningstar.com

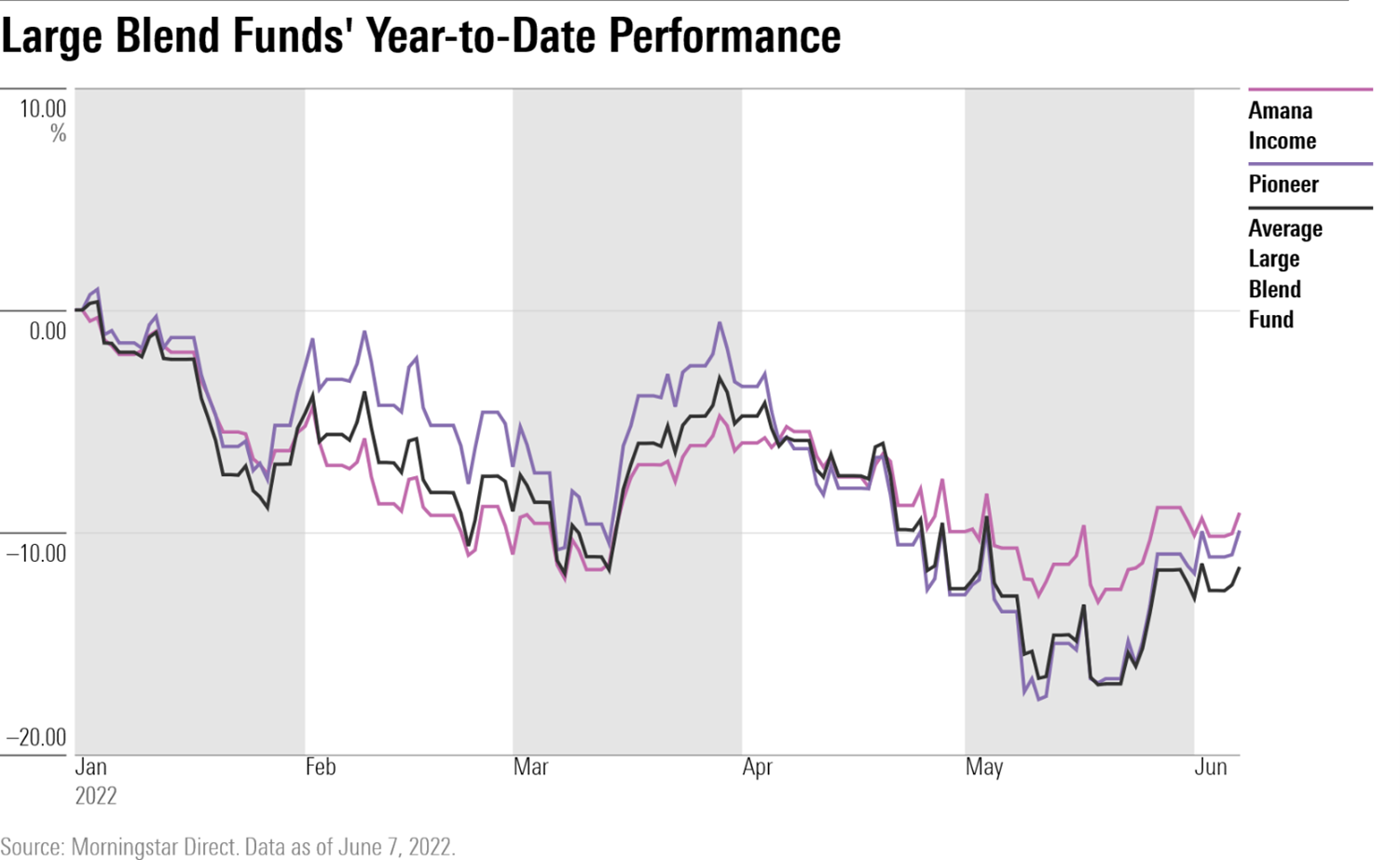

2022′s Top Sustainable Funds Weather a Tough Market Morningstar, Mahi roy , and alyssa stankiewicz feb 5, 2024. Supply chain sustainability will become a critical focus, with.

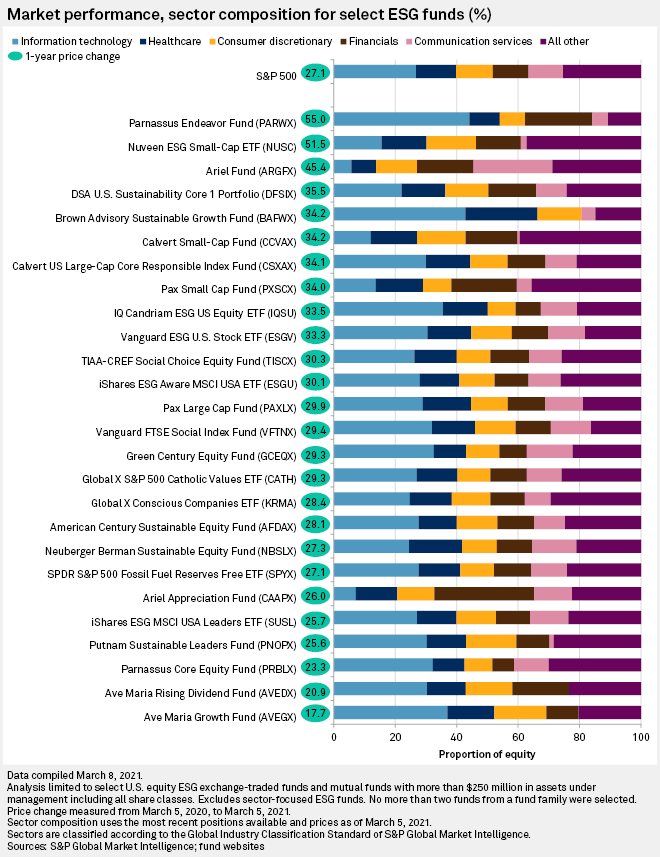

Source: www.spglobal.com

Source: www.spglobal.com

Daily Update April 15, 2021 S&P Global, (1) a substantial 83% of consumers believe companies should actively shape esg best. Stock etf (esgv) due to a combination of low fees and high diversification.

Source: www.ft.com

Source: www.ft.com

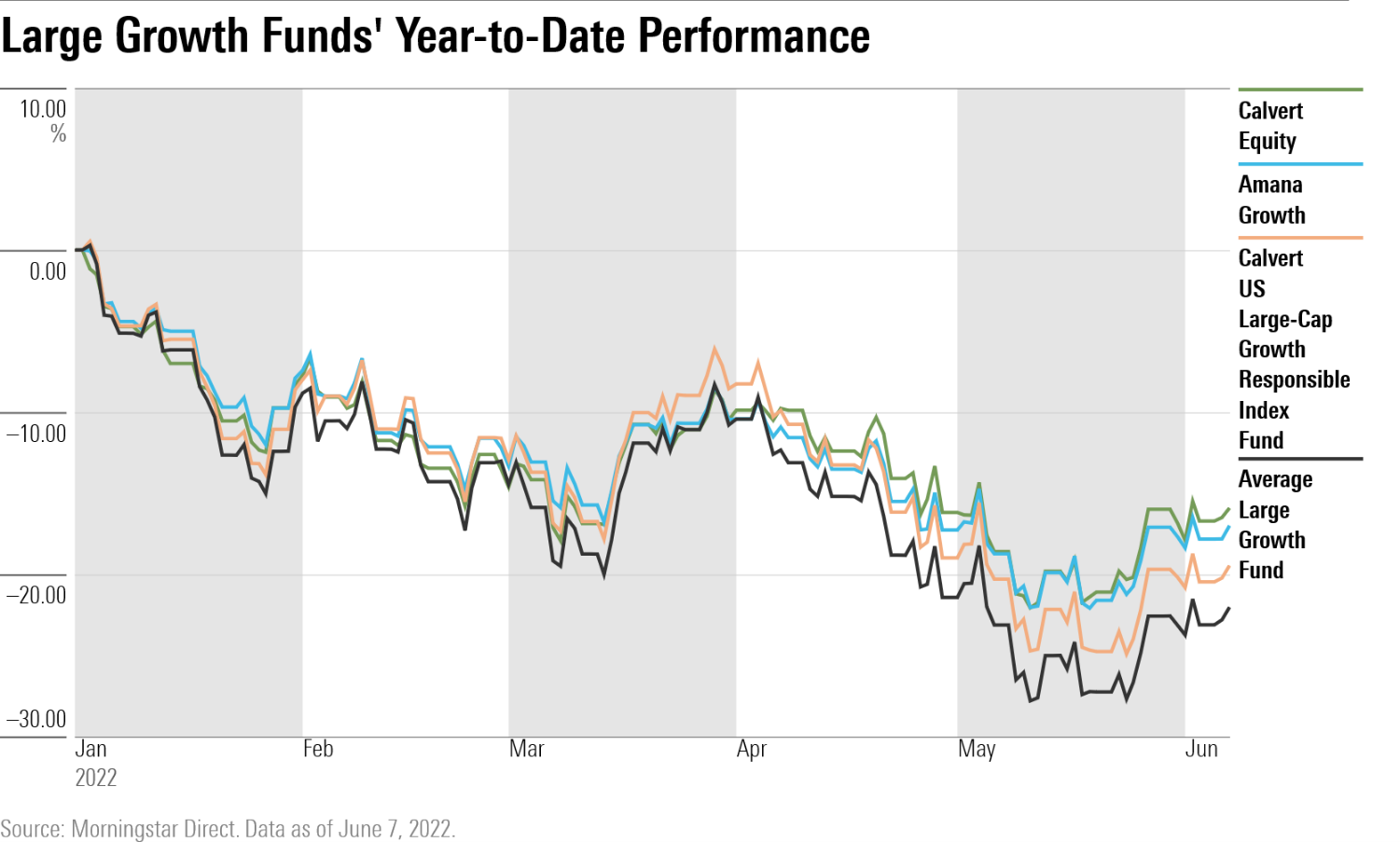

‘Collateral damage’ ESG funds pulled down by tumble in tech shares, Review the fund’s historical performance—just keep in mind that past performance is not indicative of future results. Here are six of the most important.

Source: www.morningstar.com

Source: www.morningstar.com

2022′s Top Sustainable Funds Weather a Tough Market Morningstar, Esg issues will transition from being optional extras to integral elements of corporate strategy, essential for generating sustained value. What is next for esg in 2024?

Source: www.reuters.com

Source: www.reuters.com

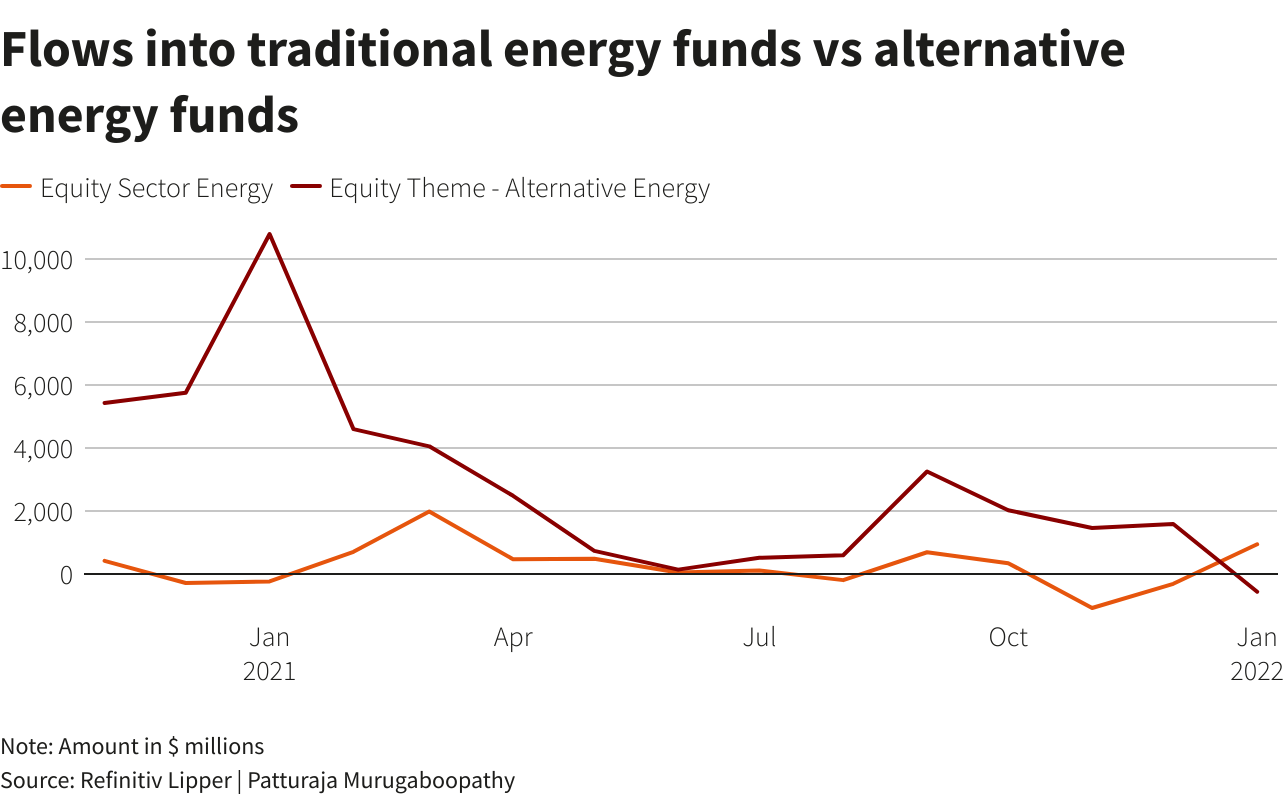

ESG funds set for first annual outflows in a decade after bruising year, We screened the funds with a morningstar sustainability rating and narrowed those down to those with 4 and 5 globes, which means they are rated as above average or high on. Our analysts break down trends by asset class and region.

Source: www.intentionalendowments.org

Source: www.intentionalendowments.org

The COVID19 Downturn and ESG Investing Intentional Endowments Network, Mahi roy , and alyssa stankiewicz feb 5, 2024. Private equity firms must accept that esg has become a strategic imperative, says petra funds group md charlie chipchase.

Source: bullsnbears.com

Source: bullsnbears.com

ESG Underperformance Will Be Its Undoing Secular Bull, So, what can we expect in 2024? Esg funds are known for having higher.

What is ESG Investing? Definition & Fundamentals [2023] Finbold, Additionally, with the us sec releasing disclosure rules for esg funds in 2024, it would not be surprising to see a potential csa consultation on esg fund disclosures. What is next for esg in 2024?

Source: www.morningstar.com

Source: www.morningstar.com

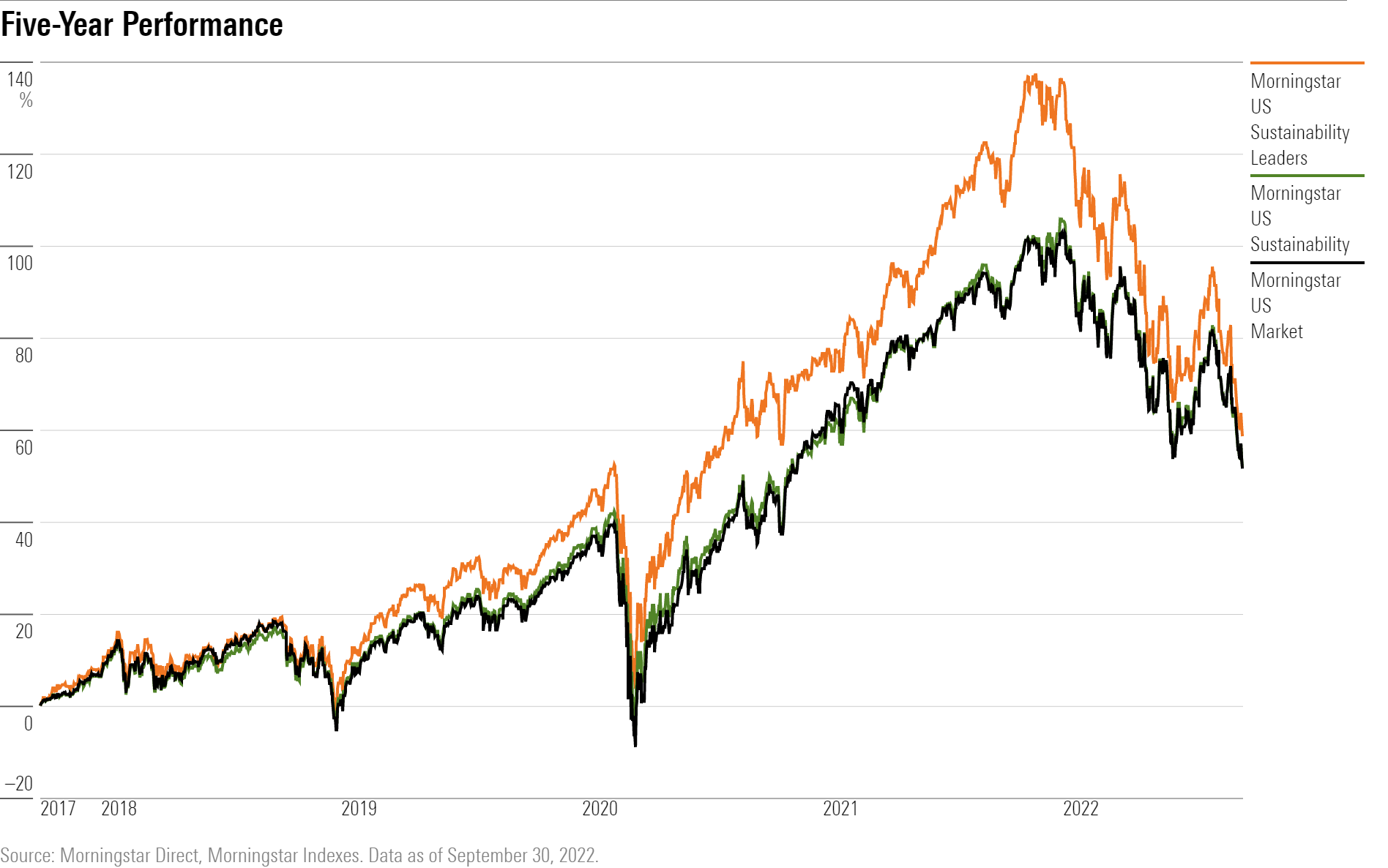

SustainableInvesting Performance Struggled Again for Q3 Morningstar, Stock etf (esgv) due to a combination of low fees and high diversification. What is next for esg in 2024?

Source: www.kitco.com

Source: www.kitco.com

Investors back ESG stock funds even as tech slide hurts returns Kitco, Supply chain sustainability will become a critical focus, with. We screened the funds with a morningstar sustainability rating and narrowed those down to those with 4 and 5 globes, which means they are rated as above average or high on.

This Is A Relatively Stable Amount Compared To 2023, Which We Estimate At €815 Billion By The End Of The Year.

Esg issues will transition from being optional extras to integral elements of corporate strategy, essential for generating sustained value.

Stax’s Clients Across Private Equity.

Stock etf (esgv) due to a combination of low fees and high diversification.