529 Contribution Limits 2025 Married Couple. The vast majority of people do not need to worry about this, as. Because contributions to a 529 plan are considered gifts, individuals can contribute up to $18,000 per year to a beneficiary’s 529 account without filing a gift tax.

Instead, limits are based on aggregate. The annual gift tax exclusion is $18,000 per recipient in 2025 ($36,000 for a married couple giving jointly) and $17,000 in 2023.

So, If You Have Multiple.

As a single parent with three children and three 529 plans, you can contribute $18,000 to each plan annually.

If You’re Married, Both You And Your Spouse Can Claim The Annual Exclusion (Totaling Up To $30,000) By Filing A Gift Tax Return Separately.

This exclusion is an individual one, meaning a married couple giving jointly could gift up to $36,000 to one beneficiary in 2025.

529 Contribution Limits 2025 Married Couple Images References :

Source: www.cfnc.org

Source: www.cfnc.org

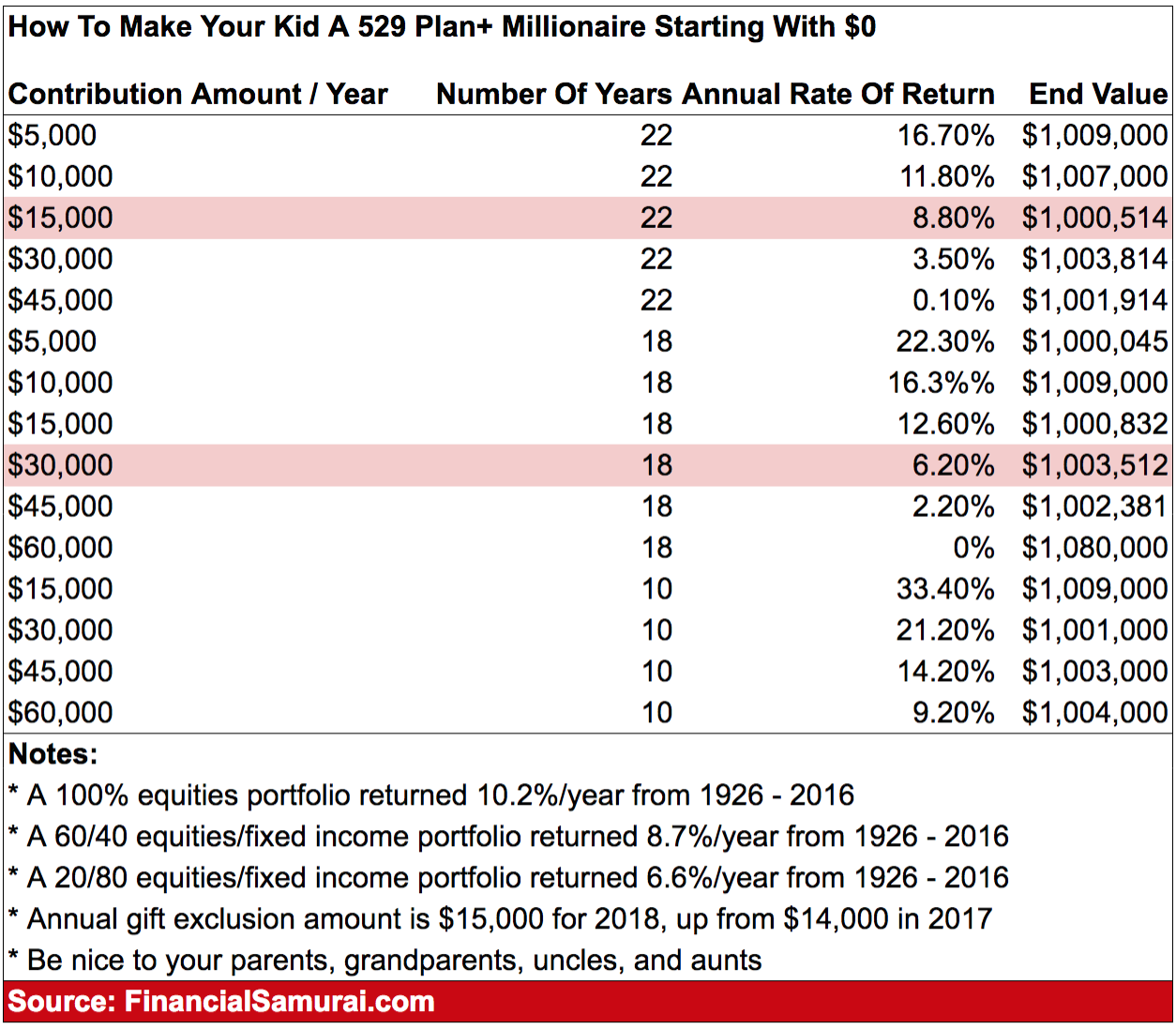

529 Contribution Limits for Married Couples, Those saving for retirement may deposit up to $7,000 to an ira (up from. Because contributions to a 529 plan are considered gifts, individuals can contribute up to $18,000 per year to a beneficiary’s 529 account without filing a gift tax.

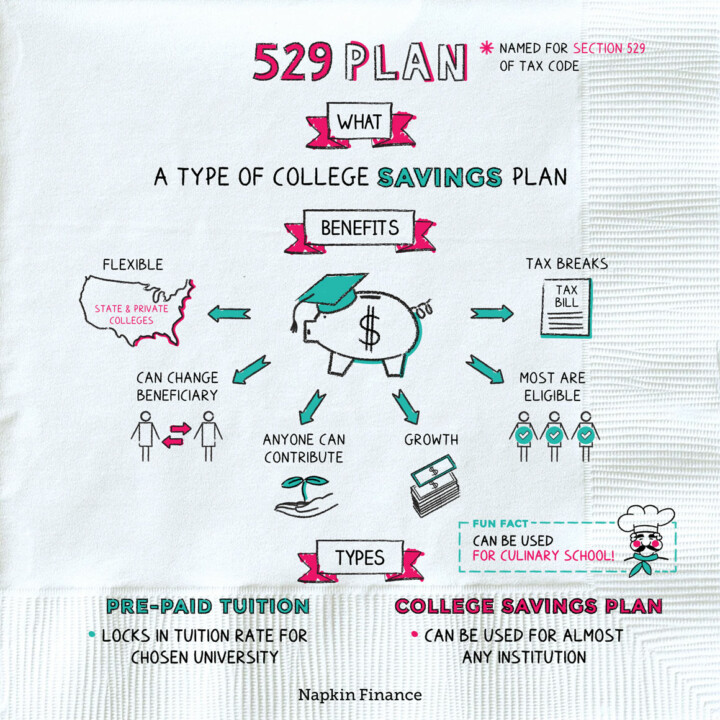

Source: napkinfinance.com

Source: napkinfinance.com

What is a 529 Plan? Napkin Finance, Is the amount total contribution limit or for each of. You can contribute up to five years’ worth of gift contributions at once—$90,000 as an individual or $180,000 as a married couple.

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits (How Much Can You Contribute Every Year, For example, the total rollover amount is limited to $35,000, annual roth ira contribution limits apply, the 529 account has to have been open for at least 15 years,. You could contribute $75,000 in 2021 or $80,000 in 2022 (or $150,000 or $160,000 for a married couple) to a beneficiary’s 529 in one lump sum, but your irs form 709 must reflect your option to take the.

Source: www.pinterest.es

Source: www.pinterest.es

529 Plan Contribution Limits How to plan, 529 plan, 529 college, You can contribute up to five years’ worth of gift contributions at once—$90,000 as an individual or $180,000 as a married couple. Instead, limits are based on aggregate.

Source: finance.gov.capital

Source: finance.gov.capital

What is a 529 Plan Contribution Limit? Finance.Gov.Capital, Wanted to see your thoughts on what is the max contribution limit from a married couple to kid's 529 plan? A married couple can contribute $32,000 to.

Source: mungfali.com

Source: mungfali.com

529 Coverdell Comparison Charts, The vast majority of people do not need to worry about this, as. 529 contribution limits for married couples.

Source: dadmba.com

Source: dadmba.com

Beginner's Guide to 529 College Savings Plan Dad MBA, If you’re married, both you and your spouse can claim the annual exclusion (totaling up to $30,000) by filing a gift tax return separately. So, if you have multiple.

Source: www.youtube.com

Source: www.youtube.com

The Tax Benefits and Contribution Limits of a 529 Account YouTube, Some examples of situations that. To be eligible to receive the state contribution you must make the minimum contribution of $25, $100, or $250, based on your household income (as verified by the office of the.

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits Rise In 2023 YouTube, In 2025, the annual 529 plan contribution limit rises to $18,000 per contributor. 529 plans do have an aggregate limit that.

Source: sondrawenid.pages.dev

Source: sondrawenid.pages.dev

2025 Standard Deduction Over 65 Married Edyth Haleigh, The annual gift tax exclusion is $18,000 per recipient in 2025 ($36,000 for a married couple giving jointly) and $17,000 in 2023. Learn about the contribution and account balance limits on 529 plans and the difference in contribution limits among states.

Since Each Donor Can Contribute Up To $18,000 Per Beneficiary, A Married Couple Can Contribute Up To $36,000 In A Single Year Per Child Without Needing To File.

You can contribute up to five years’ worth of gift contributions at once—$90,000 as an individual or $180,000 as a married couple.

To Be Eligible To Receive The State Contribution You Must Make The Minimum Contribution Of $25, $100, Or $250, Based On Your Household Income (As Verified By The Office Of The.

As a single parent with three children and three 529 plans, you can contribute $18,000 to each plan annually.

Posted in 2025